City Treasurer

The Department of Finance is responsible for the proper collection and disbursement of City funds and providing a wide range of financial reporting. Below you can find downloadable applications, information on local taxes, business owner's information and applications for city funding.

Business Owners Information

Business License

Each business within the City of Scottsville is required to have a business license. The business license fee is $30.00 and is valid for one year. To acquire a business license please fill out the Business License Application located in the Document Center (above) and return it, along with $30.00, to the Treasurer's Office.

Firework Business Permit and License

The permits are $1,000 for both seasonal and permanent retailers.

The applications are in the City Treasurer’s office and payments should also be made there. If there are any questions about the application, permit, or process contact Jerry Biddle, the code enforcement officer at (270)606-0394.

IMPORTANT DOWNLOADS FOR BUSINESS OWNERS

Below are important downloads for business owners and operators in Scottsville.

Net Profits Occupational License Fee Return

Occupational Business License Registration Application

Quarterly Occupational Tax Return

City Funding

The city is currently accepting applications for civic and community organization funding. Applications are due by April 30, 2024.

City Funding Application 2025-2026

LOCAL TAXES

The City of Scottsville collects property taxes for all property located within the City limits and occupational taxes on all businesses located within the City limits.

Property Tax

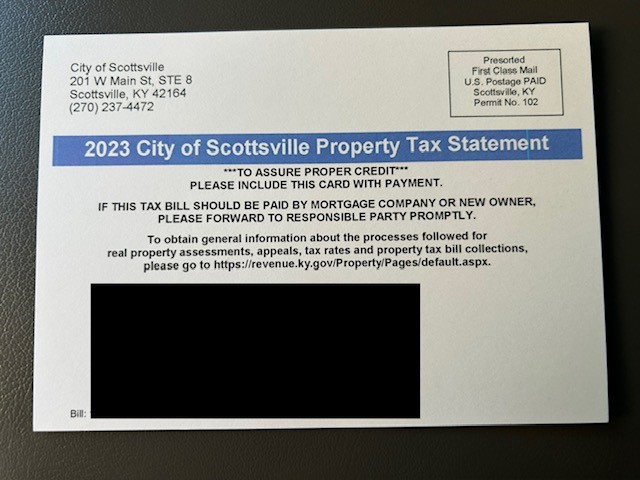

The property tax rate is .214% for bills that were issued in 2023. If you need property tax information on a specific property, please call our tax department at 270-237-4472.

2024 City of Scottsville Property taxes have been mailed. Last year postcards were all blue, but due to colored cardstock being unavailable this year there is a blue strip that identifies the white card as your city tax bill. The discount amount is due by December 15th.

Business License

Each business within the City of Scottsville is required to have a business license. The business license fee is $30.00 and is valid for one year. To acquire a business license please fill out the Business License Application located in the Document Center (above) and return it, along with $30.00, to the Treasurer's Office.

Occupational Tax

In addition to a Business License, businesses located in the City that have employees are required to withhold a 1.5% local occupational tax and submit to the City quarterly along with the Occupational Tax Withholdings Form.

Occupational Annual Tax Reconciliation

Employers are also required to submit an Annual Reconciliation Form and an annual Net Profit Return for each calendar year. All required forms can be found in the Document Center (above).

Please note there is a minimum Net Profit fee of $30.00. However, if you have a current Business License, then you may apply a credit of $30.00.

If you have any questions, or would like to close your business account with the City of Scottsville Occupational Taxes, please contact the City Treasurer's office.

Evelina Anderson, City Treasurer

Beth Ann Hall, Accounts Payable/Tax Administrator